- All

- Commercial property market

- Commuting and accessibility

- Housing market

- Land use planning

- Other

- Uncategorized

Empty homes, longer commutes: Effects of more restrictive local planning

Attempting to regulate housing vacancies away by allocating less land or being more restrictive with respect to new building or adaptation of existing structures, in fact increases the proportion of local homes that are empty as well making people who work in the area commute further. The absolute opposite of what the advocates of the policy want to achieve.

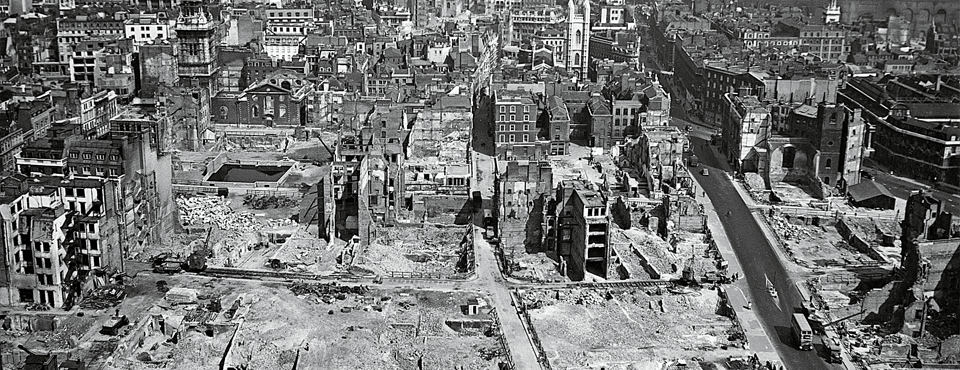

The Billion Pound Drop: Did the Blitz enhance London’s economy?

By Gerard Dericks and Hans Koster The Blitz lasted from September 1940 to May 1941, during which the Luftwaffe dropped 18,291 tons of high explosives and countless incendiaries across Greater London. Although these attacks have now largely faded from living memory, our recent paper ”The Billion Pound Drop” shows that the impact of the Blitz…

Why are homes sold above the asking price?

In 2016, more than half of the homes offered for sale in Amsterdam were sold above the asking price. This percentage was also high in other Dutch cities. But why would one pay more than the asking price? When the number of bidders is high, and there is uncertainty about the quality of the property, economic theory predicts that the highest bidder always pays too much: the so-called “winners curse”. It is shown that homes sold above the asking price had a lower initial asking price, a shorter selling time and a 3.5% higher selling price.

Parking policy: Do residents benefit from paid parking?

Nowadays it’s almost impossible to find a free parking spot in the large cities of the Netherlands. The main goal of paid parking is to reduce the demand for the limited amount of available parking space, which makes it easier for car drivers to find a vacant parking spot and leaves more space available for land use other than parking. But what about the residents of those cities? Should they vote in favour of paid parking – or not?

The mixed effects of mixed land use

In recent decades, the concept of mixed land use (MLU) has been hailed by urban planners for diminishing the demand for car transport and improving the vitality of urban neighbourhoods. My thesis attempts to better understand how diversity affects the value of land in an urban area. The findings indicate that in general firms dislike mixing with other land uses within the same building while preferring to locate on a mixed street. This suggests that solely from a producer’s perspective, horizontal mixing (on the street) is preferred to vertical mixing (within a building).

Are big-box stores emptying the city centre?

In recent years, many governments have adopted restrictive policies in response to the opening of big-box supermarkets. The economic consequences of the opening up of these new supermarkets became an important policy concern in most countries. A recent study shows that after the first big-box opening, between 20 and 30% of the grocery stores in the area disappear, offering clear evidence that city centres are losing part of their economic activity. However, when focusing on other retailers, the results also indicate that most of the empty commercial premises are taken by other type of small retailers. Hence, big-box store opening is a big threat to grocery stores, making them shut down after the opening, but it does not seem to be the case for the city centre’s activity in general.

You cannot regulate empty houses away

“Almost 57,000 homes in London stand empty…” writes David Smith in the Guardian on May 4th. This he claims is a significant cause of London’s housing problem and the “Key to this is tackling buy-to-leave investing.” The answer to this ‘problem’ is for the mayor to refuse planning permission and for Boroughs ”…to introduce planning restrictions …to prohibit the deliberate practice of letting properties lie empty.“ However, is making planning permission more difficult to get or imposing additional conditions a feasible way of reducing the proportion of empty homes?

London’s Congestion Charge and its Effects on Office Rents

Modern cities enjoy many benefits connected to dense population and proximity of firms, but also face negative effects of agglomeration. In an urban context, external effects of traffic like noise and air pollution, or traffic congestion are some of the most significant issues for policy makers. In theory, congestion charging leads to the situation that everyone pays for the costs their trip imposes on others. London is one of the most famous examples of a large city introducing an inner city congestion zone. The policy required a strong political effort and met resistance from the public and the commercial sector inside the congestion zone. But does this resistance makes sense? Have office locations in the congestion charge zone become more or less attractive due to the implementation of the congestion charge?

Parking and car ownership: Will cheap parking spaces increase car ownership?

Many cities in Europa are congested. A high population density and historic city centres imply that there is little space left that can be used for parking. Parking in European cities is therefore expensive. In the Netherlands residents can get a parking permit so that for them it is possible to park their cars close to their homes. In Amsterdam, households pay usually about €100 to € 400 for a yearly parking permit. This is not much if we compare it with the prices that are paid on the market for parking spaces in the city centre of Amsterdam or the prices visitors have to pay. But what are the economic effects of these implicit parking subsidies?

Housing values, gas extraction and earthquakes

Earthquakes in the northern parts of the Netherlands generate notable house price decreases. We have analysed the negative economic effects for homeowners of earthquakes induced by gas extraction. Earthquakes with a magnitute above 2.2 are shown to generate house price decreases of 1.2 percent. In the Netherlands, homeowners are fully compensated for earthquake damage to their residential buildings by the gas extraction company, which is a regulated monopolist. Despite this compensation, house price decreases have been shown by the economists. The average decrease induced by an earthquake with a magnitude above 2.2 is about €2500 ($ 2750) per property. The house price reduction in the whole area due to these man-made earthquakes is about €150 million ($165 million) or € 500 ($550) per household.