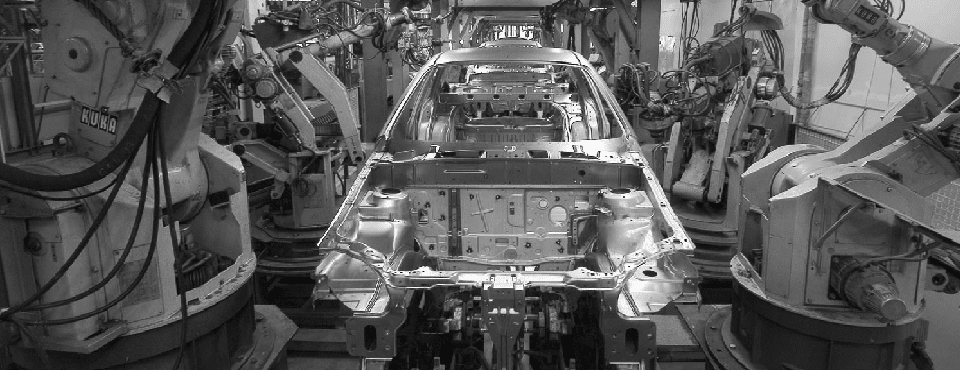

Industrial robots on workers: Winners and losers

Theory suggests that ‘directly affected’ workers who perform substitutable tasks, such as those employed in blue-collar, routine occupations, are more likely to be losers from robot adoption, while the productivity gains these machines bring could benefit workers performing complementary tasks. But there is surprisingly little evidence on this first-order protection. This column uses data from the Netherlands to show that directly affected workers face lower earnings and employment rates, while other workers indirectly gain from robot adoption. This is true both for workers employed in robot-adopting firms and their competitors.

Parking and car ownership: Will cheap parking spaces increase car ownership?

Many cities in Europa are congested. A high population density and historic city centres imply that there is little space left that can be used for parking. Parking in European cities is therefore expensive. In the Netherlands residents can get a parking permit so that for them it is possible to park their cars close to their homes. In Amsterdam, households pay usually about €100 to € 400 for a yearly parking permit. This is not much if we compare it with the prices that are paid on the market for parking spaces in the city centre of Amsterdam or the prices visitors have to pay. But what are the economic effects of these implicit parking subsidies?

Housing values, gas extraction and earthquakes

Earthquakes in the northern parts of the Netherlands generate notable house price decreases. We have analysed the negative economic effects for homeowners of earthquakes induced by gas extraction. Earthquakes with a magnitute above 2.2 are shown to generate house price decreases of 1.2 percent. In the Netherlands, homeowners are fully compensated for earthquake damage to their residential buildings by the gas extraction company, which is a regulated monopolist. Despite this compensation, house price decreases have been shown by the economists. The average decrease induced by an earthquake with a magnitude above 2.2 is about €2500 ($ 2750) per property. The house price reduction in the whole area due to these man-made earthquakes is about €150 million ($165 million) or € 500 ($550) per household.

Should we invest in historic buildings?

In many countries, vast amounts of public money are invested to preserve historic buildings. In the Netherlands, for example, total public expenditures on renovation subsidies have been more than a billion euros since the 1970s. An important argument for these subsidies are that these historic buildings generate benefits for the surrounding neighbourhood. Indeed, few people will dislike it to have a stroll in the historic city centres of Amsterdam, Utrecht or Leiden. Although it is not hard to come up with an estimate of the costs of these investments, the potential benefits of these investments are hard to capture. This implies that we cannot make informed decisions on how much public money we are willing to spend on historic buildings and neighbourhoods.

Renewable energy and negative externalities: the effect of wind turbines on house prices

By Martijn Dröes* and Hans Koster [click here for a Dutch version of this blog] Households are in general not in favour of having wind turbines in the vicinity of their property: wind turbines may cast shadows, and imply noise and visual pollution. However, in the Netherlands the goal set by the Renewable Energy Directive is to increase the…

The local impacts of climate change: Evidence from property prices around the world

According to the International Energy Agency, overall CO2 emissions are likely to reach 12-15 gigatons by 2030. The renown British economist Nicholas Stern (2008) warns that “The world would probably lose more than half its species. Storms, floods, and droughts would probably be much more intense than they are today.” These projections have strong implications for both the insurance industry and real estate markets.

What do we know about the trillion dollar club? Understanding the economic geography of commodity trade

Commodity traders are crucial in managing global supply chains. It is linked with the financial sector on the one hand and with production, storage and distribution on the other. The industry is dominated by a few extremely large firms. Despite the sheer size of the industry, little is known about how these commodity traders manage the complex information and commodity flows, and, of course, where these activities take place. Access to and control over increasingly scarce commodities and contested supply routes are becoming more and more a geopolitical concern, so more understanding about the functioning of this industry is needed.

Multinationals and the local economy: Implications for the Dutch ‘Topsectoren’ Policy

The Dutch government has the aim to invest substantially in industrial sectors which have a comparative advantage, are relatively competitive and are internationally oriented. More than half a billion euro will be invested in nine ‘topsectoren’, including horticulture, life sciences and health, high-tech industries, and somewhat surprisingly, multinational headquarters. The idea of the somewhat distinct…

To buy or not to buy? Morality and markets

There is a shortage of donor organs for transplantation, and patients in need of an organ are typically placed on years-long waiting lists. Unfortunately, every year many people die while waiting for suitable organs. Economists have argued that a free market is the most efficient way to distribute goods, so why shouldn’t we allow for a free market in organs? In the distribution of kidneys, there is already quite a lot of trade, as one only needs one kidney to survive. If both parties (the poor guy in Nepal and the patient on the waiting list) improve their utility, why not make this market legal?

Why do shops cluster? Spatial competition and agglomeration in the Netherlands

Retail markets constitute a large fraction of the economies of most modern economies and facilitate the distribution of final goods and services to consumers. It seems that in general retail activities are clustered in city centres and secondary shopping centres. Does clustering of retailers imply larger profits or is this merely a result of urban planning? The master’s thesis Spatial Competition vs Spatial Agglomeration identifies and estimates the effect of being located close to other retailers of the same type on how much retailers pay for shopping space.